Plenty has happened in Singapore’s property scene since the start of the year.

In March, there were new public housing announcements made during the Committee of Supply debate, interest rate hikes amidst banking industry turbulence, as well as emerging signs pointing towards moderating price growth in the HDB resale market.

But what do these events bode for local homeowners and property buyers?

Read on for an in-depth breakdown, plus additional insights from Eugene Lim (Key Executive Officer) of ERA’s Senior Management Team!

What are your thoughts about the housing-related announcements made during this year’s Committee of Supply debate?

Eugene: About the Committee of Supply (COS), there were quite a number of housing-related announcements made during the debate, though I think homebuyers will be most interested in the ones concerning first-timers.

In his COS speech this year, Minister Desmond Lee spoke about giving “stronger support to young married couples and parents” as well as giving such first-timers more targeted help in their journey towards home ownership.

To be specific, these groups include families with children aged 18 or below and young married couples under the age of 40.

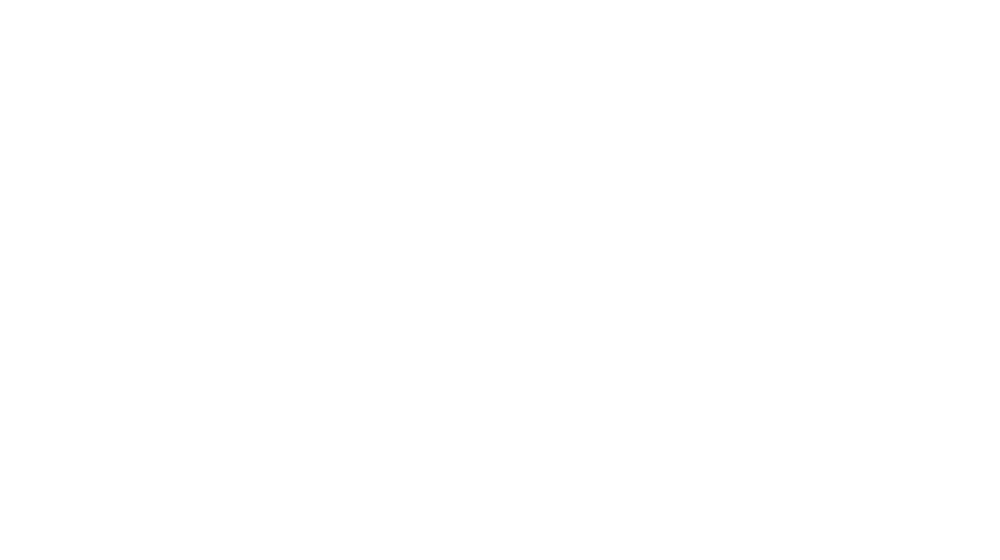

A new priority category called “First-Timers (Parents & Married Couples)”, or FT (PMC) in short, was also introduced.

From the August 2023 BTO exercise onwards, qualifying first-timers will receive an additional ballot chance when applying for a BTO or Sales of Balance flat, and they will also benefit from increased flat allocation as well as higher priority under the Family and Parenthood Priority Scheme.

These changes are a step in the right direction and can be viewed as a multi-pronged effort by the Government to address issues concerning the availability and accessibility of HDB homes for young Singaporeans.

Taken as a whole with other recent measures – such as Budget 2023’s increased CPF housing grants for first-timers buying a resale HDB flat – this is likely to help in levelling the playing field for participants in Singapore’s property market, especially those who may have less purchasing power and/or urgent housing needs.

At the same time, first-time homebuyers should be aware of the stricter restrictions on the non-selection of BTO flats.

It was announced during the COS that applicants who accumulate one non-selection count will be considered as second-timers for a year; they will also have to wait for that long before they are allowed to apply for a flat again.

These changes will go into effect during the August 2023 BTO exercise, same as the targeted support for homebuyers who fall under the FT (PMC) category.

Although these increased restrictions are expected to help HDB attain its goal of allocation efficiency, they are also unlikely to trigger a shift in younger Singaporeans’ attitudes about obtaining a home that meets their requirements.

Hence, there is a chance that we may see a drop in BTO application numbers, coupled with increased interest in the HDB resale market in coming months.

How concerned should homeowners be about the recent turbulence in the banking sector?

Eugene: Generally speaking, property owners in Singapore need not fear excessively about the recent developments happening in the banking sector.

While the news surrounding Silicon Valley Bank, Signature Bank and Credit Suisse is indeed worrying, there have not been any major ramifications on our local financial institutions.

Furthermore, the Monetary Authority of Singapore (MAS) has issued a statement on the matter, affirming that “Singapore’s banking system remains sound and resilient” even in the face of heightened volatility in global financial markets.

In the same statement, MAS also outlined the various contingencies that banks in Singapore have in place, including maintaining ample capital and conducting “regular stress tests” that safeguard against risks, such as sudden interest rate spikes.

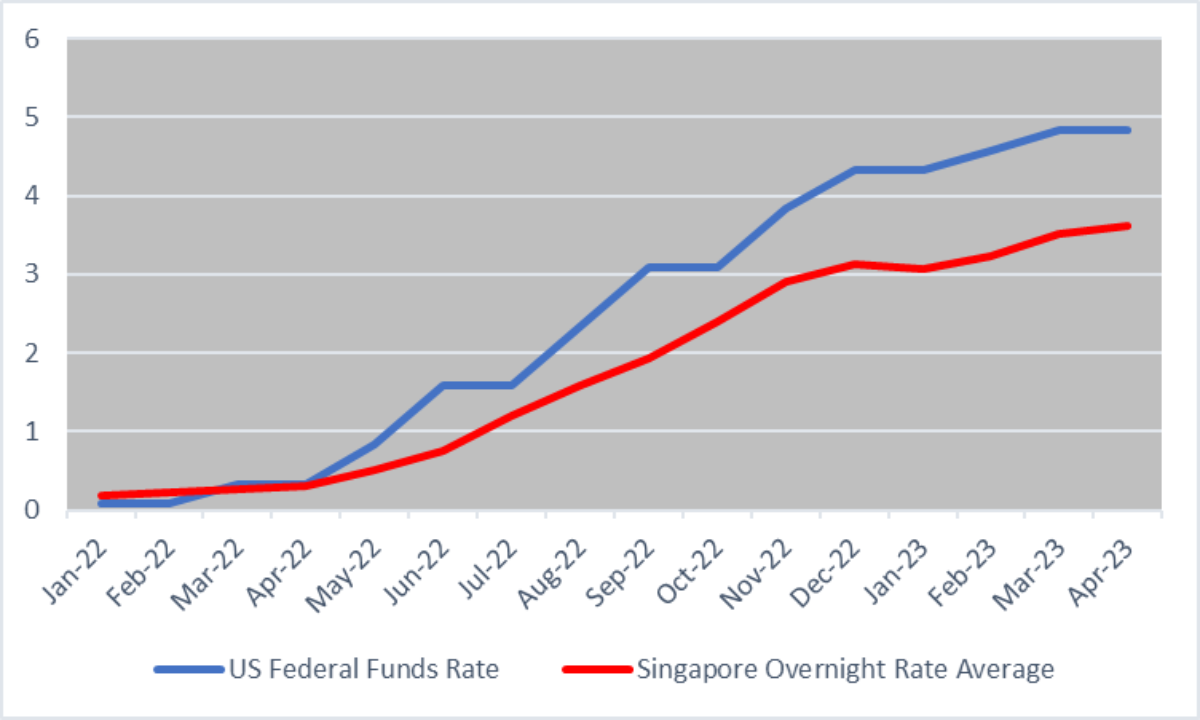

On the topic of interest rates, Singapore homeowners with mortgages may wish to keep an eye on Singapore and US interest rate movements, especially in the current inflationary environment.

This is because the rates of most home loans in Singapore are tied to the Singapore Overnight Rate Average (SORA), which in turn closely tracks the movements of benchmark rates set by the US Federal Bank.

Despite the fact that the Fed rate was only hiked by a quarter of a percentage point (0.25%) in March owing to banking sector instability, officials of the US central bank remain dedicated to battling inflation and have stated that “one more interest rate hike this year” is possible.

As a result, Singapore homeowners who have a variable rate home loan may expect their monthly payments to continue rising, at least for the foreseeable future.

What are your thoughts about the potential stabilisation of HDB resale prices and the Singapore property market?

Eugene: Recently, there have been signs that HDB resale prices may be stabilising, and this is likely to be a significant development for prospective sellers as well as the local property market as a whole.

Flash estimates released by HDB in early April showed that the prices of resale HDB flats had grown at a slower pace in the first quarter of 2023 compared to previous periods.

| Year | Quarter | Resale Price Index | % Change from last quarter |

| 2023 | 1st (Flash estimate) | 173.4 | 0.9% |

| 2022 | 4th | 171.9 | 2.3% |

| 3rd | 168.1 | 2.6% | |

| 2nd | 163.9 | 2.8% | |

| 1st | 159.5 | 2.4% | |

| 2021 | 4th | 155.7 | 3.4% |

| 3rd | 150.6 | 2.9% | |

| 2nd | 146.4 | 3.0% | |

| 1st | 142.2 | 3.0% | |

| 2020 | 4th | 138.1 | 3.1% |

| 3rd | 133.9 | 1.5% | |

| 2nd | 131.9 | 0.3% | |

| 1st | 131.5 | 0.0% |

Source: HDB

Quarter-on-quarter, the Resale Price Index (RPI) rose by 0.9% – making it the smallest increase in the last 10 quarters.

However, when examining the RPI over a three-year period, it should be noted that the prices of HDB resale flats had risen by 31.9% from Q1 2020 to Q1 2023.

This represents a faster rate of growth in the prices for resale HDB homes vis-à-vis private residential properties, which had appreciated by 27.9% (152.1 points in Q1 2020 to 194.6 points in Q1 2023) across the same period, according to Urban Redevelopment Authority (URA) statistics.

A number of reasons have led to the moderation in resale HDB price growth, which is expected to continue in the coming months. These include a substantial supply of 23,000 BTO apartments set to be launched in 2023, as well as more purchasers exercising caution due to concerns about higher cash-over-valuation.

As such, we may expect the range of price increases for resale HDB flats to be around 5% to 7% this year. From the perspective of sellers, this suggests that they will not be under pressure to lower prices, though it is likely that more affordably-valued properties could lead to faster offers.

Disclaimer for consumers

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers.

For avoidance of doubt, ERA Realty Network and its salespersons accept no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.