Like with other big-ticket purchases, there’ll be various tasks accompanying your purchase of a new home, such as making moving arrangements, planning renovation works, as well as finding suitable financing options.

Covering the monthly cost of mortgages, in particular, has proven to be relatively tough for some Singapore property owners in recent months, owing mostly to a challenging economic environment fraught with high interest rates and inflationary pressures.

According to a recent OCBC Bank survey, 40% of Singaporean respondents indicated they faced difficulty in paying off their mortgage loans, underscoring the importance of weighing one’s financing options carefully.

So, if you’re debating between an HDB loan and a bank loan, read on for our breakdown of both!

How can you obtain financing for a house in Singapore?

In Singapore, the majority of property purchases are financed either through an HDB loan or a bank loan.

Though other modes of financing are available locally, such as borrowing against personal assets (e.g. another property) or engaging the services of licensed moneylenders, these options are less-used for various reasons, including comparatively higher costs of borrowing.

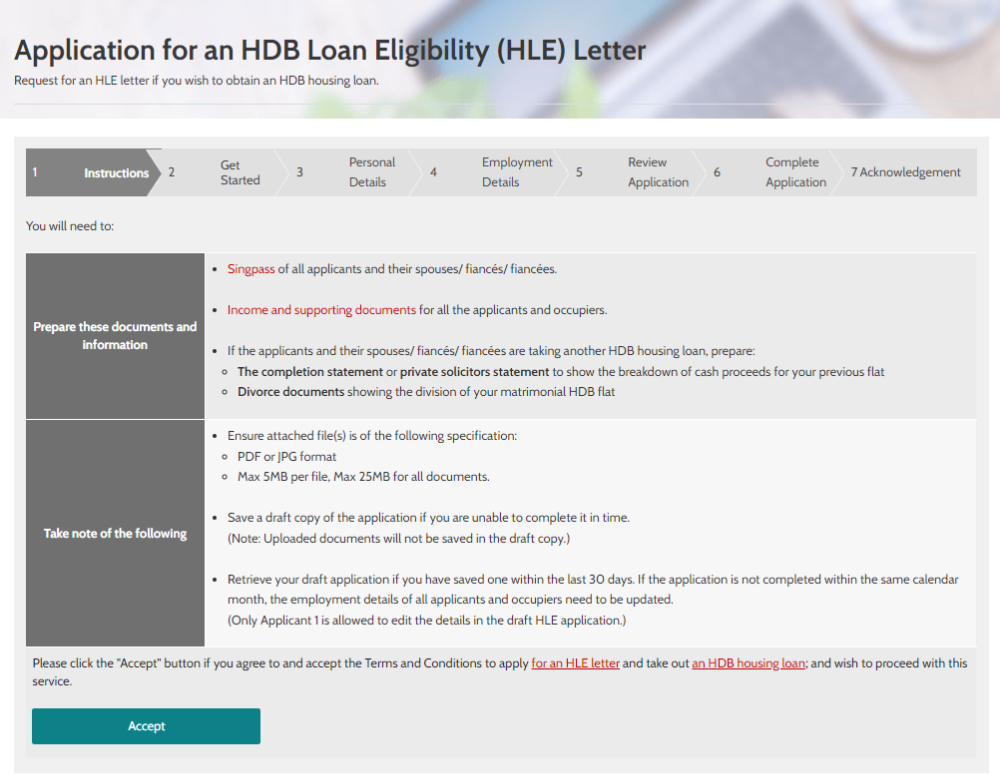

HDB loans are provided by the Housing Development Board, and HDB flat buyers may obtain one after applying for an HDB Loan Eligibility Letter (HLE).

By acquiring a valid HLE, buyers not only get confirmation about their eligibility for an HDB loan, they’ll also be able to use it to book a flat with HDB or obtain an Option to Purchase (OTP) that’ll enable them to buy a resale HDB flat.

Bank loans, on the other hand, are provided by financial institutions in Singapore (e.g. DBS, POSB, OCBC, etc) and are usually applied for after the option fee is paid and before the OTP is exercised.

HDB loans and bank loans, how are they different?

While HDB loans and bank loans serve the same purpose of helping homebuyers purchase a property in Singapore, there are several key differences between these financing options.

Interest rates

Based on how interest rates are determined, bank loans can be broadly categorised into fixed rate and variable rate loans.

In the case of the fixed rate bank loans, interest rates will stay unchanged for a stipulated period; this is usually 3 to 5 years, but the exact length depends on the lending bank and mortgage package chosen. This also means that the instalment amount paid every month will remain the same too – albeit only for a limited time.

Once its lock-in period ceases, a fixed rate bank loan will function similarly to a variable rate bank loan and its interest rate will be referenced to a benchmark, such as the Singapore Overnight Rate Average (SORA).

Although HDB loans aren’t strictly fixed rate loans, they might be considered as such due to their stability.

At present, the concessionary interest rate on an HDB loan is pegged at 0.1% above the Ordinary Account (OA) interest rate of 2.5% – but this could change if the Government deems it necessary to adjust either the 0.1% margin or the OA interest rate.

Eligibility

Unlike housing loans offered by banks, HDB loans have a stricter set of criteria that applicants must adhere to.

Other than not owning an interest in any private residential property OR disposing one in the last 30 months prior to applying for an HLE letter, HDB loan applicants must also ensure that:

- At least one buyer/applicant is a Singapore Citizen.

- All applicants have not taken two or more HDB housing loans.

- Their combined household monthly income doesn’t exceed $14,000 (for families) or $7,000 (for singles).

- They don’t own more than one commercial property, and if they do own one, they must be operating a business at said property while having no other sources of income.

And the list continues, check out HDB’s official website for a full overview of all the requirements needed to apply for an HDB loan.

Downpayment percentage

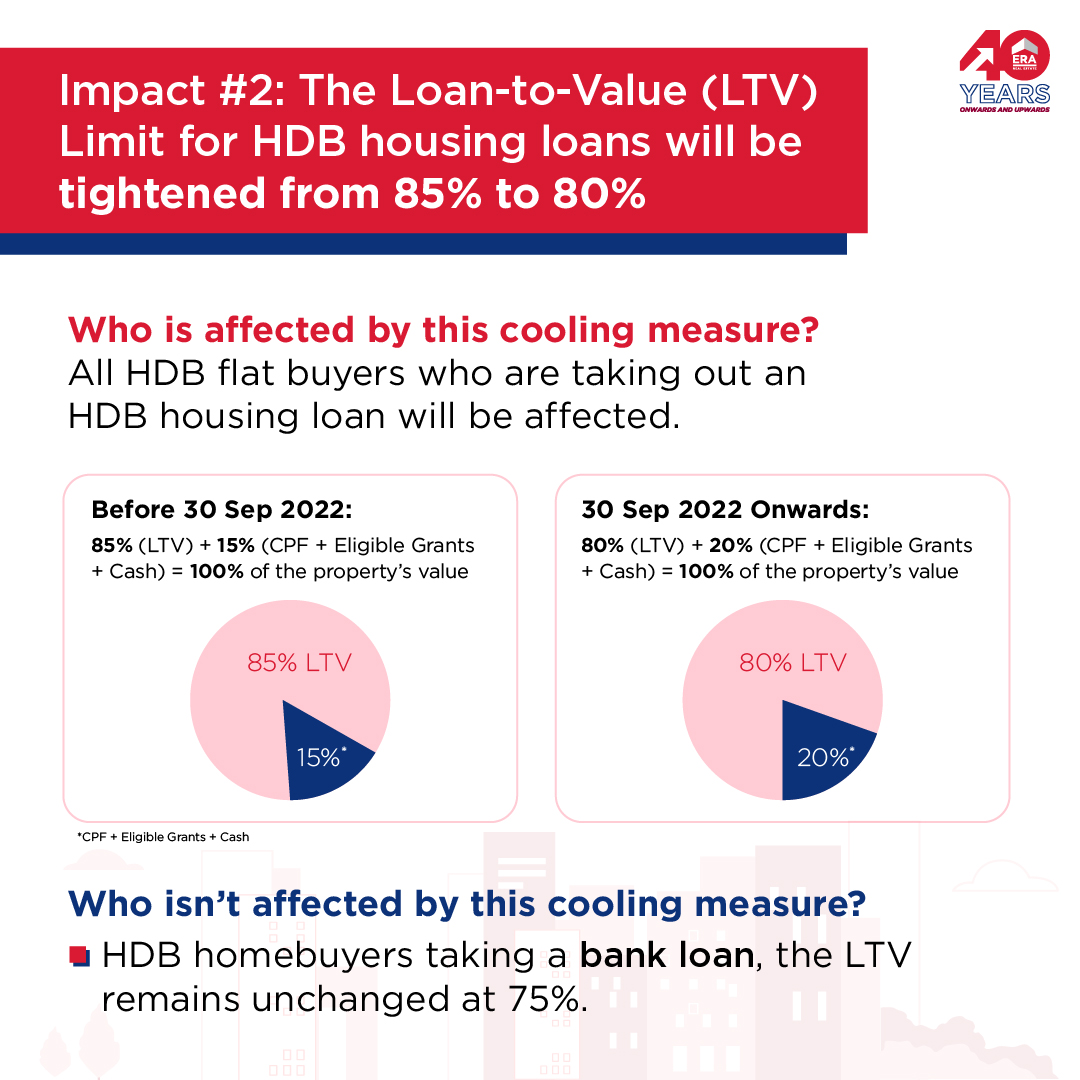

Prior to the rollout of new cooling measures in September 2022 that tightened the Loan-to-Value (LTV) limit, homebuyers in Singapore could borrow up to 85% of their flat’s value if they were to opt for an HDB loan.

Or, to put it another way, the downpayment amount they had to fork out previously was lower at 15% (presently, 20%).

In contrast, bank loans have an LTV limit of 75%, with the remaining 25% to be paid as downpayment. Furthermore, for bank loans, it’s worth noting that a portion of the downpayment sum amounting to 5% of the property’s price must be paid in cash.

Flexibility in refinancing

The term ‘refinancing’ is frequently brought up in discussions about home loans and it refers to the act of replacing a current mortgage with another, usually one with a more favourable interest rate or terms such as a shorter loan tenure.

Where this comes into play is that current takers of HDB loans are free to refinance their mortgages with a bank (i.e. switch to a more favourable bank loan) and are able to do so without incurring any penalties.

Conversely, homebuyers with an existing bank loan are unable to swap to an HDB loan and are only able to refinance their mortgage with another bank.

Loan tenure

Loan tenure is another important factor to consider when comparing mortgages since it affects how long it takes to pay off a loan and, in turn, the amount of interest paid.

In the case of HDB loans, tenure is capped at whichever is the shortest, either 25 years, up till the buyer reaches 65 years of age, or the remaining lease of the property minus 20 years.

Meanwhile, bank loans have a maximum permissible tenure of 35 years, which may make them more appealing to homebuyers who want affordable monthly repayments at the expense of higher total interest paid over the life of the mortgage.

So, which should you pick? An HDB loan or a bank loan?

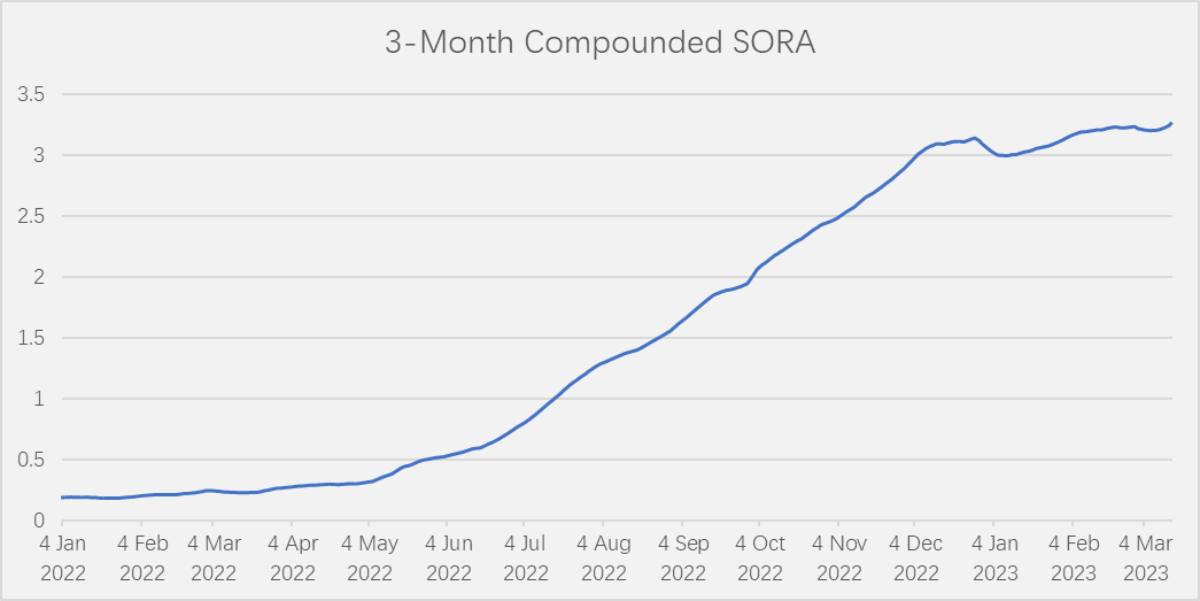

Since early 2022, interest rates have been on the rise, so it’s no surprise that local homeowners are getting increasingly antsy about the cost of borrowing in Singapore.

Over the course of a year, the three-month compounded Singapore Overnight Rate Average (a.k.a. SORA, the main floating rate benchmark used by most banks) rose by about 3 percentage points on the back of various global events and foreign economic policies.

This upwards trend brings SORA to roughly 3.2%, which is higher than the 2.6% interest rate presently offered on HDB loans.

So, with this in mind, homebuyers may wish to take up an HDB loan if they would like more stability in the present rising interest rate environment. Alternatively, they may wish to refinance to a fixed-rate loan package with a bank to hedge against possible future increases.

Still feeing unsure? Speak to your bank and/or an ERA Trusted Advisor for more advice on finding a suitable home loan!

Disclaimer for consumers

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers.

For avoidance of doubt, ERA Realty Network and its salespersons accept no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.